Peak Investor Panic? The Decisions Made Today May Last a Lifetime...

The last three weeks will go down in the history books as one of the most violent black swan events to hit the stock market. Over the past 21 trading days, the S&P 500 has declined by an astonishing -32.54% from its February 19th peak as investors were blindsided by an unpredictable black swan risk event known as COVID-19i.

In response to the continued uncertainty as it relates to the economic impact of COVID-19, we recorded a 30-minute investor playbook that will take a step by step approach on prudent ways to navigate market uncertainty and to use periods of peak panic to our long-term investment advantage. To view our video playbook, please watch the video below.

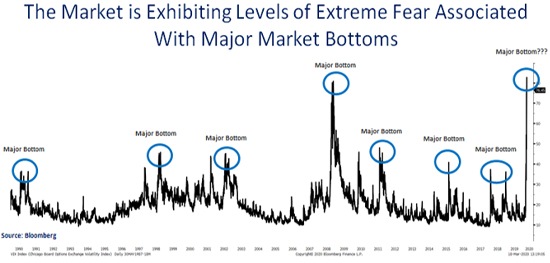

Investors cannot control nor predict black swan events such as COVID-19, the attacks of September 11th or the Japanese attack of Pearl Harbor, but we can control our response as investors, during periods of maximum fear. As we enter the fourth week of this market panic, the evidence is undeniable, we have reached a period of “peak investor panic”. As investors scramble for portfolio protection and sell stocks at any price, history suggests that such behavior takes place during generational stock market bottoms.

When we look back throughout history, the VIXii, which is quite simply the demand for put options (betting that stocks will decline) vs. the demand for call options (betting that stocks will go up), reaches panic peaks prior to every major stock market bottom. During this time period, hopelessness and despair pervades the investor psyche, leading to the relentless urge to sell. Its at this point of maximum panic that stock markets have a nasty habit of pricing in the worst case scenario and climbing that wall of market worry.

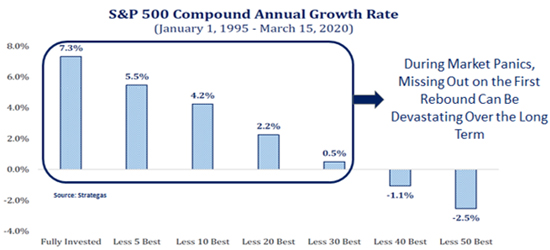

Experience through all sorts of crazy market environments has taught us that no matter what the cause of a market selloff is, whether it’s a black swan event such as COVID-19 or traditional recession fears, periods of peak investor panic are times to be opportunistic, not fearful. In fact, caving into market fear can permanently impair your portfolio’s potential long-term rate of return.

The chart below illustrates the devastating impact that panicked selling can have on an investor’s long term rate of return. Clients that ignore the panic and stay invested in the market, have been able to generate a long-term annualized growth rate of close to 7.3%iii. While certain clients may intend to re-enter the market, missing the first few days of the market recovery can have a devastating impact on your long-term rate of return. For those clients that simply miss the 5 best days of the market, which often occur at the beginning of the recovery, their compound annual growth rate shrinks from 7.3% to 5.5%. For those that miss the 30 best days, the returns shrink from 7.5% to a devastating 0.5%.

The message here is that while the current stock market decline associated with the outbreak of COVID-19 is scary and can seem endless with no way out, history tells us that now is the worst time to sell and an opportunistic moment to buy. Allowing our fears to take control of our investment decisions is the greatest danger to our long-term investment success. For those that can overcome their fears and see the forest through the trees, opportunity awaits as some of America’s best of breed companies are now on sale for 30% off.

Regardless of what the stock market does, we know that it is a scary and uncertain time for everyone across the country. While we cannot control the spread of COVID-19, we can use fear to our long-term investment advantage. Rest assured that no matter what happens over the coming days, weeks and months, our team will be here at our offices ready to serve and guide you through these uncertain times. If you have any questions, concerns or just want to chat, please feel free to reach out to our offices at (888)543-3776 or you can reach me directly on my mobile phone at (858)354-5114. Thank you for your continued loyalty, trust and business through this period of heightened stress. Thank you again and have a fantastic week.

Investment advisory services offered through LifePro Asset Management, LLC, a registered investment adviser. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. S&P 500 is an unmanaged index of the shares of 500 widely held, predominantly large capitalization, U.S. exchange-listed common stocks. Investors cannot invest in any index directly. The index results neither include dividends reinvested nor reflect fees and expenses. Past performance is not indicative of future results. To the extent that this material contains any forward-looking statements such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” are based on management’s views and assumptions at the time such statements were originally made and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

i Source: Bloomberg covering the period February 19, 2020 – March 18, 2020

ii VIX: Created by the Chicago Board Options Exchange (CBOE), VIX is the Volatility Index. This is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments. VIX values can be one indicator to measure market risk, fear and stress of investors.

iii Source: Strategas