APPROACH

A new approach to money management.

LifePro Asset Management redefines the way assets are managed. We’ll help you discover an optimal balance between market exposure and income and principal security.

A shift in the financial planning pyramid

Our unique approach flips the financial planning pyramid around. We reduce market dependence and make income and principal protection the priority.

Social Security

LPAM maximizes the amount of Social Security you can receive by running a series of optimized calculations.

Income and Estate Protection

LPAM utilizes products that increase principal and tax protection, while accounting for inflation.

Market Exposure

LPAM puts your excess savings into the market to continue growing the value of your assets.

Manage your money with confidence

With the majority of your assets protected, you’ll be able to live the life you want as you receive a predictable and reliable stream of income.

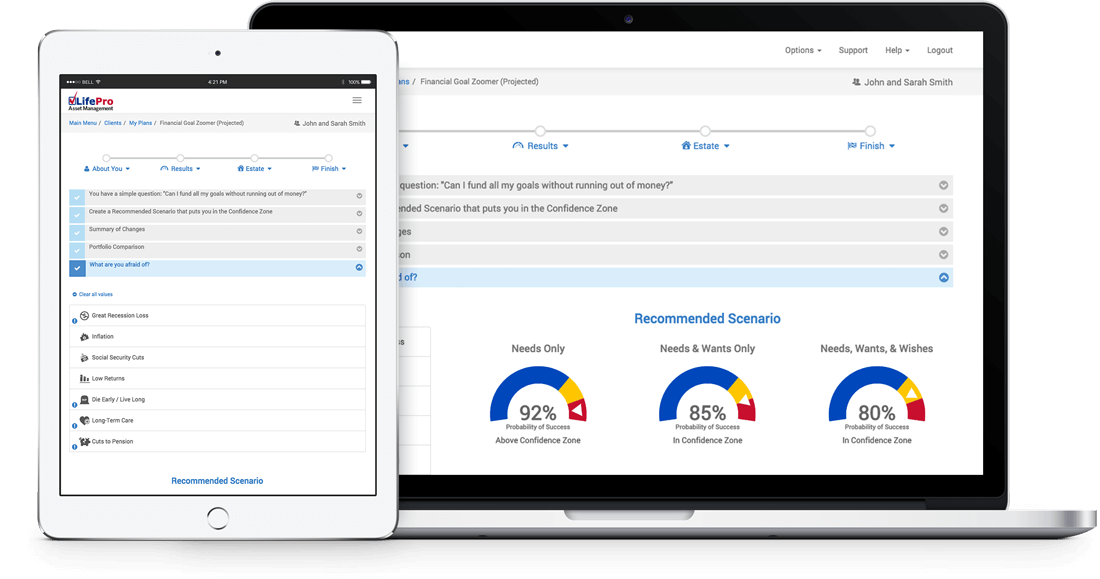

A plan built just for you

Your plan will be handcrafted and specifically designed to help you reach your goals. You’ll see percentage breakdowns of recommended scenarios to meet your needs, wants, and wishes.

Your estate under one roof

LifePro Asset Management will position all of your assets to work symbiotically and efficiently under one plan. This allows for easy access to view your accounts all under one roof.

Powered by two of the largest brokerage firms in the world

Your assets with LifePro Asset Management are fully-secured with two of the largest and most trusted brokerage firms in the world: Charles Schwab and TD Ameritrade.

Serving you with the highest standard of care

LifePro Asset Management’s relationship with you is a fiduciary one. As a fiduciary entity, we always act in your best interest. As opposed to non-fiduciary advisors, our loyalty lies within you, our customer.