INCOME SECURITY

Secure a base level of income for retirement.

LifePro Asset Management helps mitigate any potential risk that may surround your retirement income. We’ll secure a portion of your assets to generate guaranteed income for life.

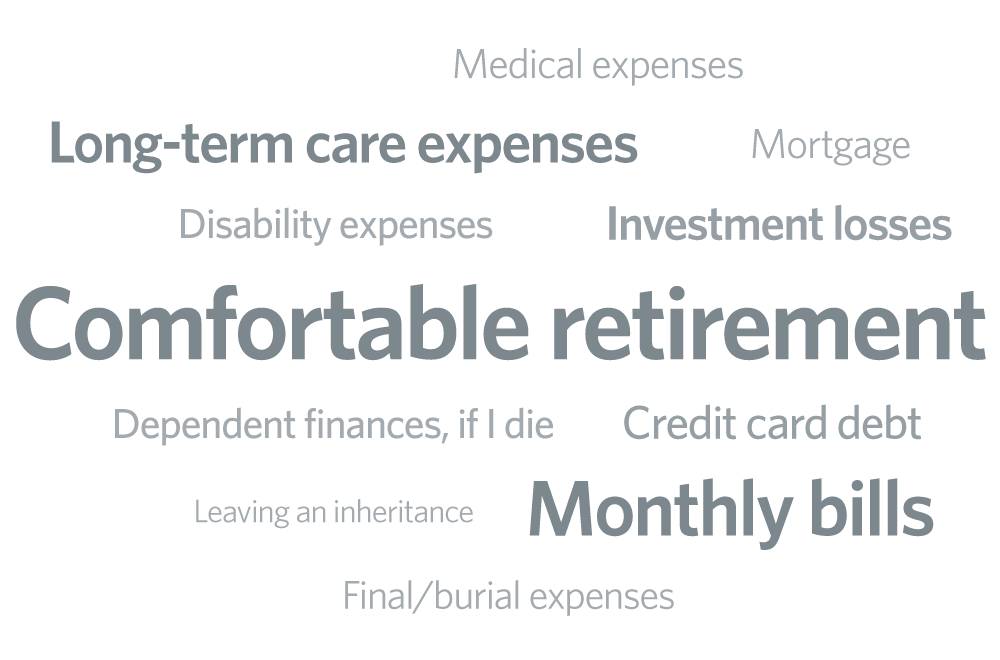

'Comfortable retirement' remains the #1 financial concern

According to a recent Insurance Barometer Study, saving for retirement remains the top financial concern and commands more attention than any other item for most consumers.

Americans of all income classes are concerned they will not have enough INCOME to secure their saving goals, monthly living expenses, and possible long-term care expenses. This has created a great deal of anxiety for many and has led people to look into their options to create a guaranteed source of retirement income.

There are only 3 sources of guaranteed retirement income.

Government benefits, such as Social Security, and any defined-benefit pensions are the two common sources that annuitize your retirement wealth. The third option to increase your amount of guaranteed income above and beyond those benefits would be from an inflation-protected life annuity from a highly-rated insurance company.

Social Security

Social Security replaces a percentage of a worker's pre-retirement income based on your lifetime earnings. The amount varies depending on earnings and when you choose to start benefits.

Pension

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. With most of the responsibility and risk being to the employer, they are becoming increasingly scarce.

Annuity

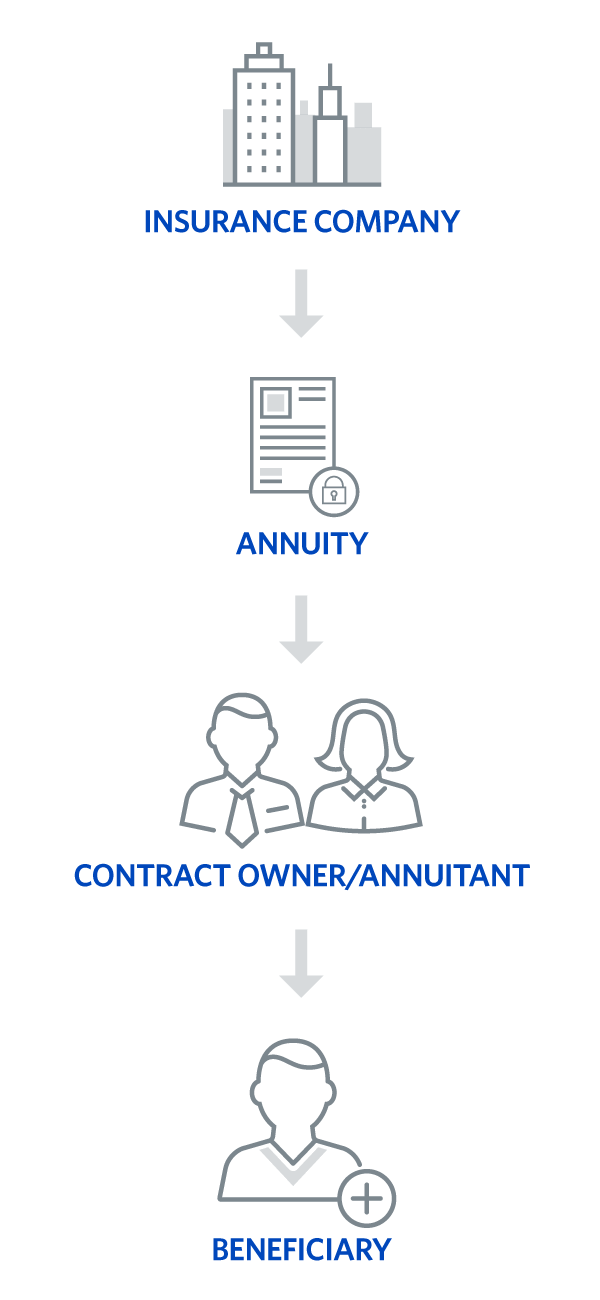

An annuity is a contract between you and an insurance company. In exchange for your premium payment, the insurance company provides you income, either starting immediately or in the near future.

SOCIAL SECURITY

Make sure you get the most out of your Social Security benefits.

As retirement approaches, you may be wondering how to best manage your money throughout your golden years and receive the maximum amount of Social Security possible.

The biggest effect you can have on your Social Security benefits is the time you claim.

For example, if a person receives $2,000 per month in Social Security at age 66, they would receive 25% less – or $1,500 – if they had signed up at age 62.

If they waited until age 70 to collect, they’d receive $2,640 per month – a 32% increase! Over a 55% difference of what they would have received at age 62.

LifePro Asset Management has built a proprietary Social Security maximization report that precisely determines what is needed to efficiently allocate your benefits and maximize the amount you receive for both you and your spouse.

This report is actively linked to statistical data from the government’s official Social Security website.

With hundreds of different scenarios ranging from the claiming ages of 62 to 70, it’s important that we analyze all of your available options so we can create the best strategy and receive the most amount of benefits at your optimal retirement ages.

Here are a few highlights from our proprietary Social Security maximization service:

- Discover your unique 'optimal retirement age' strategy. We'll analyze your unique situation, test every scenario possible, and show you which claiming option will be the best strategy.

- Compare optimal strategy against other claiming strategies. We'll show you how your optimal strategy performs against claiming at age 62, your full retirement age (FRA), and at age 70.

- Receive a shortfall analysis on your retirement income. We'll show you if (and when) there will be a shortfall to your retirement income and present you the best options for how to 'close the gap'.

ANNUITY

Guarantee a portion of your money with an annuity.

Today’s annuities offer a range of features and benefits that may help you accumulate assets for retirement, preserve what you’ve accumulated, turn those assets into a guaranteed stream of income, and help you pass on a financial legacy to your loved ones.

Most annuities have two phases. First, there’s an accumulation phase, during which you let your money earn interest. This is followed by a distribution, or payout phase, during which you receive money from your annuity.

A fixed index annuity (FIA) offers a unique combination of benefits that can help you achieve your long-term goals. No other product offers the tax-deferral, indexed interest potential, and optional benefits to protect your retirement assets and income.

The illustration to the right demonstrates who is involved within an annuity contract.

A fixed index annuity offers a unique combination of benefits that no other product offers:

Tax-deferred growth

Compounded over time, tax-deferred growth may increase the amount of savings and income your annuity generates for your retirement.

Indexed interest potential

Some annuities offer you an opportunity to accumulate interest based on changes in an external index.

Asset protection

There are a range of guarantees and optional income benefits that can help protect your assets and your retirement income.

Cash accumulation

As long as you abide by the terms of your contract, the cash accumulated inside your account is locked in and protected.

Guaranteed income

You can receive your contract's values in a stream of income that will last your lifetime (or longer). This puts you in control of your future income.

Death benefit

If you pass away before you begin to receive payouts, or in some cases after you've begun, your beneficiary will receive a death benefit.

Secure a portion of your retirement income today.

Protecting a portion of your money for income security is an important decision, and one you should only make after consulting with LifePro Asset Management.

LifePro Asset Management does not directly offer annuity products. These products are available through our affiliate and parent company, LifePro Financial Services, Inc. See additional disclosures on these products here.